SPS 2023

Private Equity Harvest Report

Deal flow has decelerated dramatically in 2023, and many firms are turning to alternative sources to meet capital deployment targets.

SPS' Private Equity Harvest suite of capabilities uniquely enhances the PE business development arsenal, enabling professionals to effectively and proactively target relevant sponsor-backed assets. With this one-of-a-kind approach, SPS clients can drill down into the profiles of other sponsors to view active and historical holdings, including add-on activity per portfolio company. PE, banker, lender, and law firm intelligence provides an unprecedented view of participants in any portfolio transaction – down to individual professional contact data.

The 2023 Private Equity Harvest Report leverages proprietary data techniques to reveal often-overlooked opportunities, analyzing PE portfolio holdings through several strategic lenses:

-

-

Strategy 1: Lower Market

-

Strategy 2: Upper Market

-

Strategy 3: Minority Investments

-

Strategy 4: Stranded Assets

-

Get the free report for an evaluation of the current landscape of active PE portfolio holdings

Deal origination traditionally focuses on cultivating relationships with intermediaries closing relevant deals and contacting companies directly. Sourcing deals from PE firms requires a similar effort, with the benefit of already knowing which assets each sponsor could potentially sell.

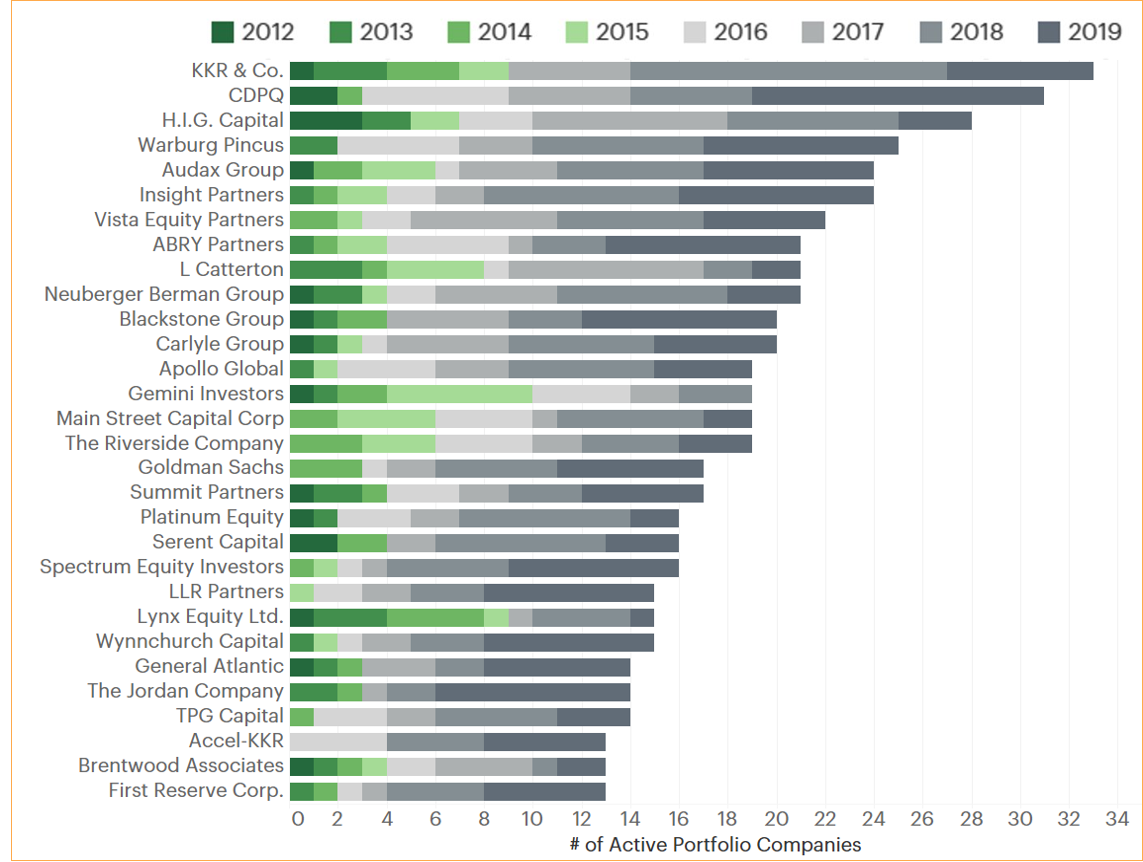

Preview: Top Sponsors with Active Portfolio Companies by Year